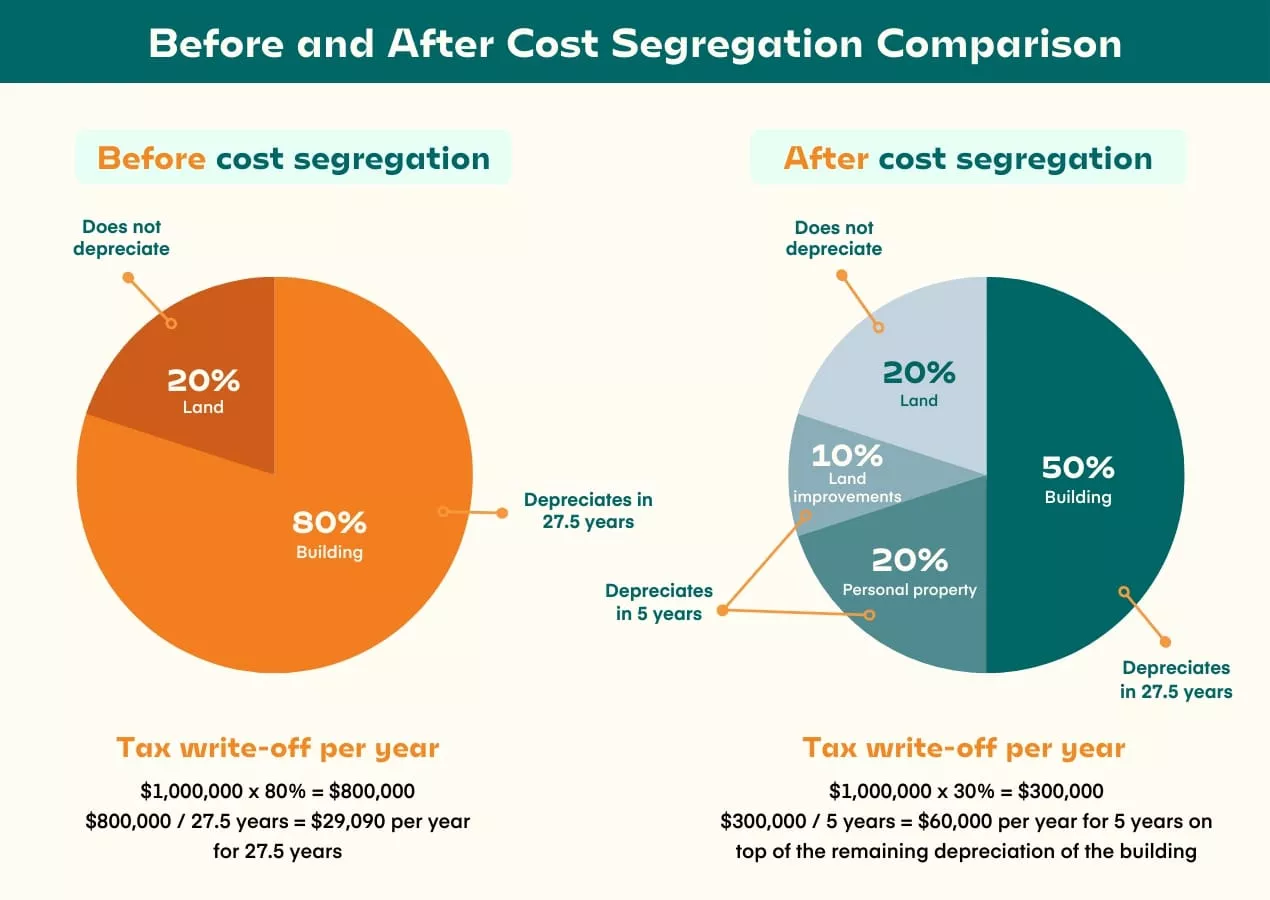

Commercial property investors should know about Cost Segregation Studies as a way to increase cash flow by accelerating depreciation of qualified assets in a building to save on income tax. Depreciation is a deduction that real estate investors can claim on their income taxes each year to help them recover the cost of owning, operating and maintaining that property. This strategy reduces the expenses of owning investment real estate. Doing this frees up money for other investments or purchases.

To obtain the most tax savings at a time when you are also spending the most dollars on your real estate, you should order a Cost Segregation Study during the same year after you buy, build or remodel a property. If you did not perform a Cost Segregation Study when you first built, purchased or remodeled a property, you can order a look-back study. This type of Cost Segregation Study allows you to claim a catch-up tax deduction. The Internal Revenue Service allows you to perform a look-back study on properties as far back as January 1, 1987.

The impact of Cost Segregation Studies can be significant. This program has been sanctioned by the Internal Revenue Service, based on the Investment Tax Credit, and could mean a savings of more than 20% on taxes for the depreciation of the non-permanent, non-structural assets of their commercial investments. Currently, the rate of depreciation for real commercial property is 39 years. Cost Segregation Studies, which analyze the components that make up the building and assign these various components with recovery periods, can provide property owners with distinct tax advantages over the straight-line depreciation method.

Contact us now for more detailed information on a Cost Segregation Study for your investment properties.